EPS – Earning Per Share – Calculate Earning Per Share

What is EPS?

EPS stands for earning per share. It means how much profit the company is making as per available shares.

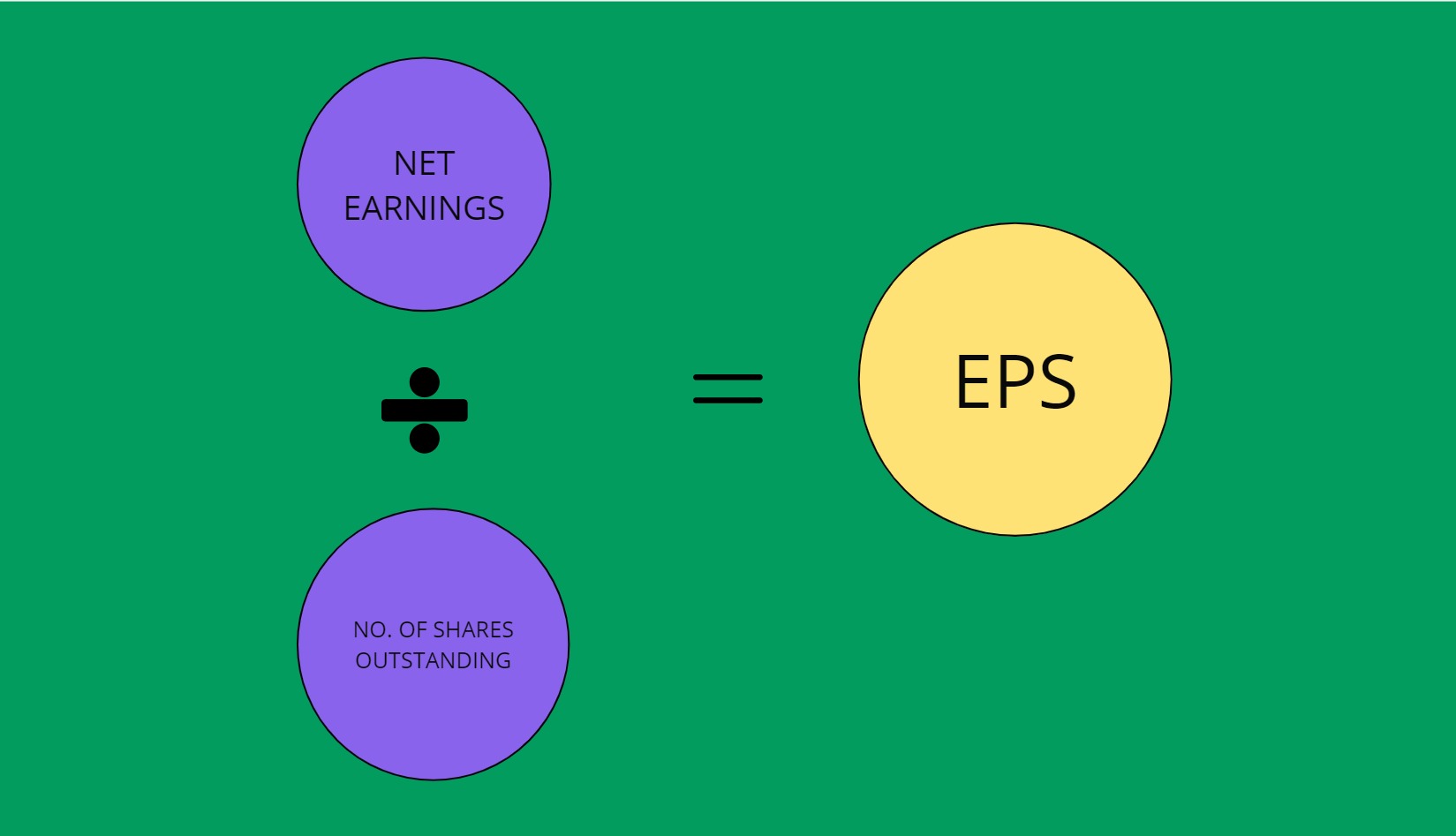

Calculate Earning Per Share

Earning per share is calculated by dividing net income by the number of available shares. For example, if company has met earning of ₹5000 and available shares in market are 1000 then EPS value will be 5000 divided by thousand which is equal to 5.

This is general formula. If we want to go deeper: (Net Income – Preferred Dividends) ÷ Weighted Average of Common Shares Outstanding

How to use EPS for your analysis?

EPS doesn’t mean how much profit a shareholder has made in a particular stock. It is more or less related to companies earnings per share.

- We can analyse a company from its EPS value by comparing with its peers.

- Generally higher EPS value is considered a good sign.

- But there are other factors that we should check for example EPS over several quarters, so that you can make sure that EPS growth is consistent because sometimes due to certain situations, EPS growth in particular quarter might be quite high but that doesn’t mean company will grow with similar EPS in future, so it becomes very crucial to carefully analyse eps.

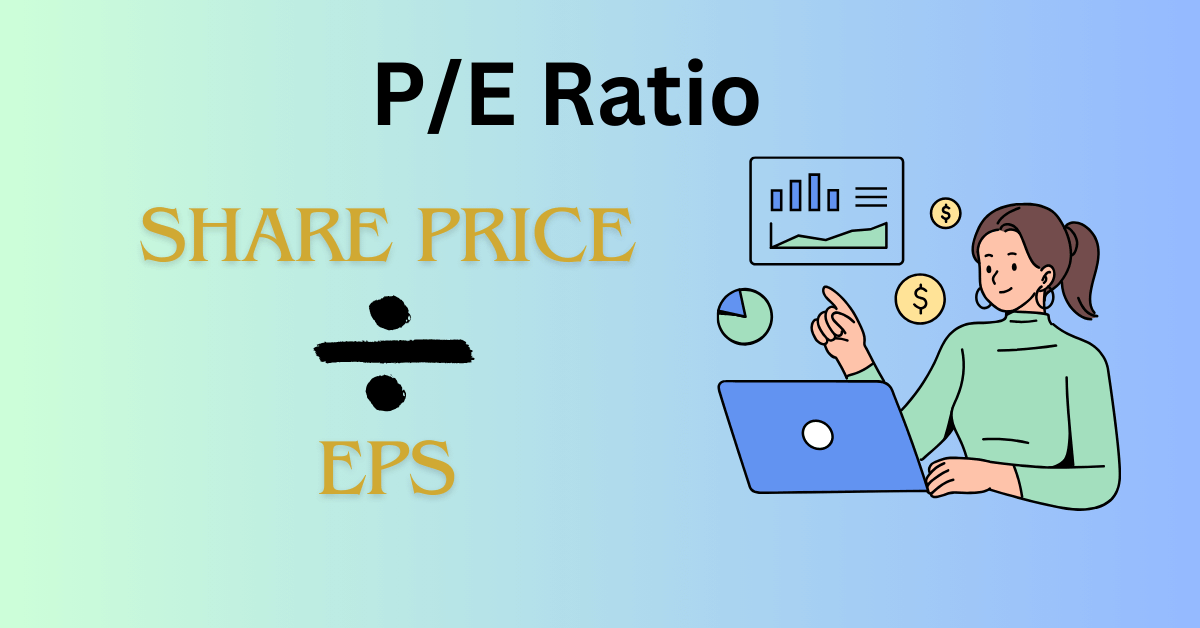

During market analysis, one Major use of EPS is to compare EPS value with actual stock value which is called PE ratio. PE ratio is a useful metric used by analysts worldwide. It is calculated as actual stock price divided by EPS. PE ratio helps to assess if a share is overvalued or undervalued.