Stock Market Fundamental Analysis

What is Stock market fundamental analysis?

Stock market fundamental analysis is an effort to find intrinsic value of a stock based upon economic, financial and qualitative factors. Core belief of fundamental analysis is that, if companies fundamentals are good its stock prices will increase sooner or later.

Fundamental analysis is widely used by long term investors and they have good reason to do so. Because stock prices can increase or decrease based upon news, overall sentiments etc. but this is for short term. It is believed that if company is doing overall good its stocks will also perfrom well in long run.

What is Technical Analysis of stocks?

Technical analysis primarily focuses on price patterns, historical trading volumes, and other market-related data. Technical analysts believe that historical price movements and patterns can provide insights into future price movements.

Technical analysis is preferred by short term traders who want to predict the market mood and act swiftly.

Which is better technical analysis or fundamental analysis?

Both approaches have been found helpful (to some extent) in the past that is the reason there is so much debate about it. We think someone should have knowledge of both. But if you have to choose one, then decision can be made based upon following factors:

If you want to invest for long term and majorly deal in Cash market(A cash market is a marketplace where assets, goods, and services are bought and sold on the spot. It is also known as the “spot market”.) then Fundamental Analysis is your good friend.

On the other hand you are short term trader, trade in derivative markets (F&O) etc. then technical analysis would be more helpful to you. Because you don’t care how much good a company is, whatever can give you quick profit is what your are looking for.

What should be included in fundamental analysis?

- Financial Statements:

- Income Statement: Revenue, expenses, profits, and earnings per share (EPS).

- Balance Sheet: Assets, liabilities, and shareholders’ equity.

- Cash Flow Statement: Operating, investing, and financing cash flows.

- Earnings and Revenue:

- Analyze historical and projected earnings growth.

- Assess revenue trends and consistency.

- Valuation Ratios:

- Price-to-Earnings (P/E) Ratio: Indicates how the market values a company’s earnings.

- Price-to-Sales (P/S) Ratio: Relates the stock price to its revenue.

- Price-to-Book (P/B) Ratio: Measures the stock’s market value relative to its book value.

- Dividends and Dividend Yield:

- Analyze the company’s dividend history.

- Consider the dividend yield, which is the annual dividend per share divided by the stock’s price.

- Debt and Liquidity:

- Examine the company’s debt levels and debt-to-equity ratio.

- Assess liquidity ratios, such as the current ratio and quick ratio.

- Profitability Ratios:

- Gross Margin: Measures the percentage of revenue retained after deducting the cost of goods sold.

- Operating Margin: Reflects operating efficiency.

- Net Profit Margin: Indicates overall profitability.

- Management and Governance:

- Assess the quality and reputation of the management team.

- Review corporate governance practices.

- Competitive Positioning:

- Analyze the company’s market share and competitive advantage.

- Assess industry trends and competition.

- Economic Indicators:

- Consider macroeconomic factors that may impact the industry or company.

- Future Growth Prospects:

- Evaluate the company’s growth initiatives and expansion plans.

- Assess industry trends and addressable market.

- Risk Factors:

- Identify and assess potential risks, both internal and external.

- Consider geopolitical, regulatory, and market risks.

- Qualitative Factors:

- Consider non-financial factors like brand strength, corporate culture, and innovation.

- Analyst Reports and Forecasts:

- Review analyst reports and consensus estimates for future performance.

- Events and News:

- Stay updated on significant company events, product launches, or legal issues.

Key terms used in fundamental analysis

- Earnings Per Share (EPS):

- Definition: The portion of a company’s profit allocated to each outstanding share of common stock.

- Formula: EPS = (Net Income – Dividends on Preferred Stock) / Average Outstanding Shares.

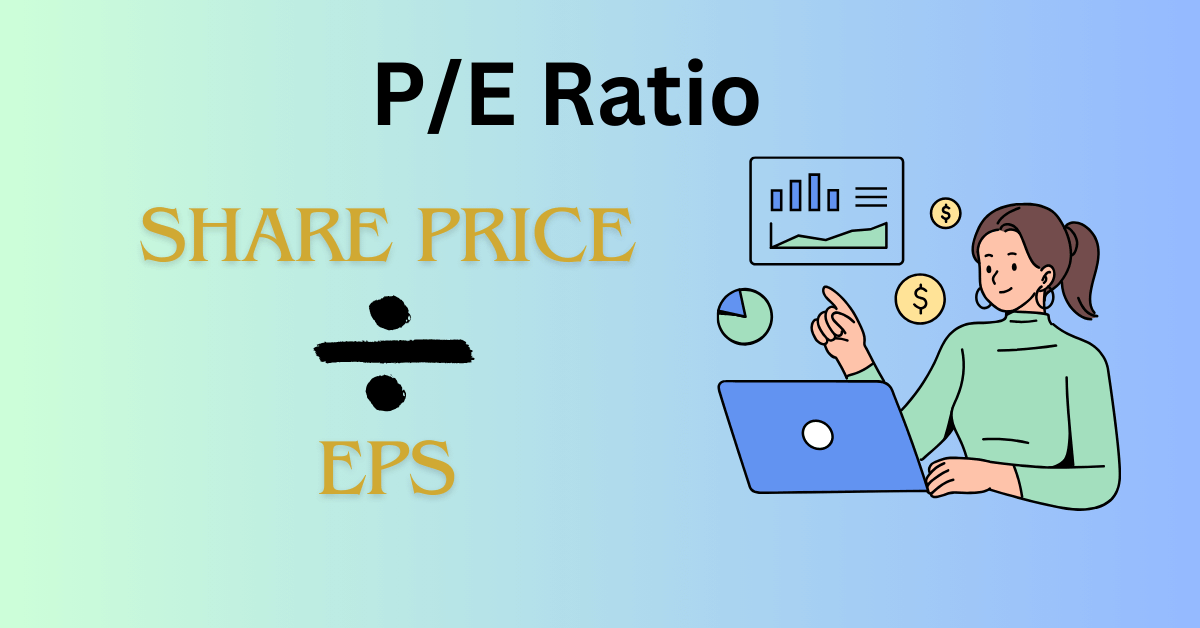

- Price-to-Earnings (P/E) Ratio:

- Definition: A valuation ratio that compares a company’s current share price to its earnings per share.

- Formula: P/E Ratio = Market Price per Share / Earnings per Share (EPS).

- Dividend Yield:

- Definition: The annual dividend income as a percentage of the current market price per share.

- Formula: Dividend Yield = Annual Dividend per Share / Market Price per Share.

- Return on Equity (ROE):

- Definition: A measure of a company’s profitability that compares net income to shareholders’ equity.

- Formula: ROE = Net Income / Shareholders’ Equity.

- Debt-to-Equity Ratio:

- Definition: A financial leverage ratio that compares a company’s total debt to its shareholders’ equity.

- Formula: Debt-to-Equity Ratio = Total Debt / Shareholders’ Equity.

- Current Ratio:

- Definition: A liquidity ratio that measures a company’s ability to cover short-term liabilities with short-term assets.

- Formula: Current Ratio = Current Assets / Current Liabilities.

- Gross Margin:

- Definition: The percentage of revenue retained after deducting the cost of goods sold.

- Formula: Gross Margin = (Revenue – Cost of Goods Sold) / Revenue.

- Net Profit Margin:

- Definition: A profitability ratio that measures the percentage of revenue retained as profit after all expenses.

- Formula: Net Profit Margin = Net Income / Revenue.

- Book Value Per Share:

- Definition: The value of a company’s total assets minus total liabilities, divided by the number of outstanding shares.

- Formula: Book Value Per Share = (Total Assets – Total Liabilities) / Outstanding Shares.

- Free Cash Flow (FCF):

- Definition: The cash generated by a company’s operations that is available for distribution to investors and debt reduction.

- Formula: FCF = Operating Cash Flow – Capital Expenditures.

- Market Capitalization:

- Definition: The total market value of a company’s outstanding shares of stock.

- Formula: Market Capitalization = Number of Outstanding Shares * Market Price per Share.

- Beta:

- Definition: A measure of a stock’s volatility in relation to the overall market.

- Interpretation: Beta > 1 indicates higher volatility, < 1 indicates lower volatility, and = 1 indicates market-average volatility.

- Working Capital:

- Definition: The difference between a company’s current assets and current liabilities.

- Formula: Working Capital = Current Assets – Current Liabilities.

- Quick Ratio (Acid-Test Ratio):

- Definition: A liquidity ratio that measures a company’s ability to meet short-term liabilities using its most liquid assets.

- Formula: Quick Ratio = (Current Assets – Inventory) / Current Liabilities.

- Cash Flow from Operations (CFO):

- Definition: The cash generated or used by a company’s normal business operations.

- Formula: CFO is often reported on the cash flow statement.

- Price-to-Book (P/B) Ratio:

- Definition: A valuation ratio that compares a company’s market price to its book value per share.

- Formula: P/B Ratio = Market Price per Share / Book Value per Share.

- Forward Price-to-Earnings (Forward P/E) Ratio:

- Definition: Similar to the P/E ratio, but uses estimated future earnings.

- Formula: Forward P/E Ratio = Estimated Future Earnings per Share / Current Market Price per Share.

- Enterprise Value (EV):

- Definition: A measure of a company’s total value, including debt and equity.

- Formula: EV = Market Capitalization + Total Debt – Cash and Cash Equivalents.

- Dividend Payout Ratio:

- Definition: The percentage of earnings paid out to shareholders in the form of dividends.

- Formula: Dividend Payout Ratio = Dividends per Share / Earnings per Share.

- PEG Ratio (Price/Earnings to Growth Ratio):

- Definition: Evaluates a stock’s valuation while taking into account earnings growth.

- Formula: PEG Ratio = P/E Ratio / Annual Earnings Growth Rate.

- Return on Assets (ROA):

- Definition: A measure of a company’s profitability relative to its total assets.

- Formula: ROA = Net Income / Total Assets.

- Economic Moat:

- Definition: A sustainable competitive advantage that allows a company to maintain its market position.

- Factors: Brand strength, cost advantages, network effects, regulatory advantages.

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA):

- Definition: A measure of a company’s operating performance, excluding certain expenses.

- Formula: EBITDA = Operating Revenue – Operating Expenses (excluding interest, taxes, depreciation, and amortization).

- Alpha and Beta:

- Definition: Measures of risk-adjusted performance (alpha) and volatility (beta) relative to a market index.

2 comments

Leave a comment

You must be logged in to post a comment.

very useful, all information at one place

useful piece of information for new investors in India. I think everyone should have a good knowledge of these before starting to invest.